Sepupus, whether we like it or not, government policy affects every single one of us. If it is good, government policy presumably can be good, helpful, and desirable for us. But when I see things like this recent move brought forth by Malaysia’s Ministry of Domestic Trade and Cost of Living, I really have to think back to that old Milton Friedman adage.

The government solution to a problem is usually as bad as the problem.

In this case, though, it is actually worse.

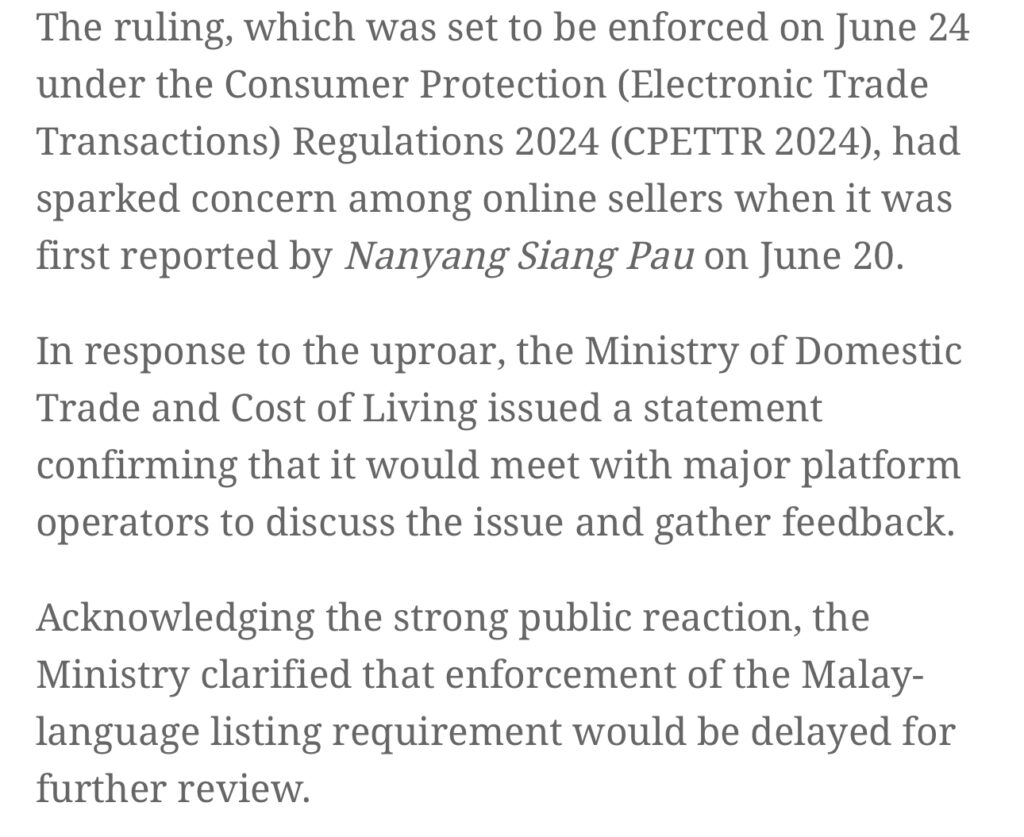

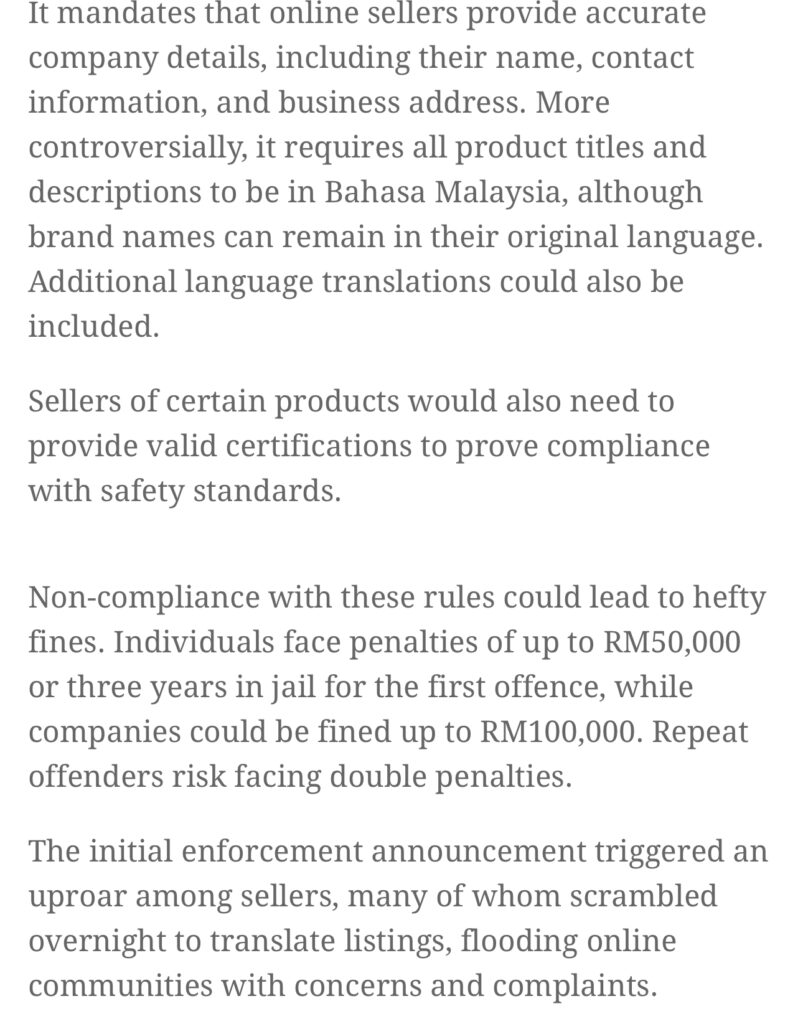

Here we have a whole government deciding that all e-commerce listings have to be in Malay and deciding to do it all in blitz regulation announced on June 20th, presumably because some uneducated politician decided that he wanted to become the most Malay, the most heroic, the most nationalist person in the entire world, planet, country, civilization, universe.

Result? Policy cancelled by June 23rd.

Now, what is the problem in this case?

Oh, there isn’t a problem, there are multiple problems.

I think that most of you who are reading this are wise and you have a sense of what’s going wrong. But anyway, why don’t we list them?

How about performative woke virtue signaling about language and national identity as if that is going to help people become more nationalistic or loyal because some idiot wants to create a career?

What about introducing regulation and U-turning at the speed of light the moment people get angry?

What about never ever once or even for a single moment of your poorly-researched life considering that anything could go wrong because you are incapable and incompetent, and you are so used to the addiction of what the baptism that you cannot imagine ever just introducing something and then getting it right?

I’m sure that there are some good policies from our government once in a while, but I think that our policymakers need to understand this: Mistakes are costly and they are much more largely and asymmetrically evaluated as disastrous than good things.

In very simple terms that I think that we can all understand, mistakes and turning back indicate a lack of political stability, which in turn directly drops demand for Malaysian currency because people are wary of investing in things that just continually change; under exchange rate determination theory (which clearly you’re not expected to understand in detail or in full but are most welcome to), a drop in demand for currency ceteris paribus (which means ‘all things held equal’, and that we’ll talk more about later) leads to a drop in the exchange rate value – if this were an economics exam for A Levels or IB, you could analyze it like this. (Free membership required)

If you haven’t signed up yet, make sure to Join Now!

Alright, I hope you enjoyed that analysis. More of that to come later, likely as a case study or sample commentary for the International Baccalaureate Economics IA.

Here’s my point.

Pandering to so-called national identity without reference to the market or what would be desirable or beneficial for the market as opposed to meaningless and ultimately useless things is not likely to be beneficial for anyone, whether from a cultural and linguistic perspective or from the perspective of actually making Malaysia a slightly better place. Instead, it will make people think that Malaysia is a basket case – Not that they didn’t already think it was, given its corruption scandals, language policy flip-flops, religious sabre-rattling, and hundreds of different flavors of identity politics and politics combined with religion that reflect an immature political and economic culture.

There is no scenario whereby this would make most people any happier, nor would it actually increase sales from e-commerce; instead, it is likely to decrease them. It would also impose unnecessary costs upon e-commerce sellers and users in the first place. This is the reason why the government had to U-turn – because they had to spend time, money, and effort dealing with this kind of nonsense.

It is shocking to me that there are still politicians in this country who would try this kind of thing without learning from experience.

It is like dying in a video game and then proceeding to die repeatedly in the exact same way without ever learning anything over and over again thinking that somehow you could do the same thing in order to try to claim victory, either because you were unable to read history or you were too stupid to recognize patterns.

Well, here’s a pattern for you, one observed by Albert Einstein himself.

Insanity is doing the same thing over and over again and expecting different results.

There is a chance that that didn’t actually come from Albert Einstein though I cannot confirm that he did not say it, but anyway…

Woke policies are not how you redeem the pride of your country. They are the way to destroy it over and over again until there is nothing left, and egotistical politicians with pet projects to try to make their names by so-called being heroes for the country are not a gift to the nation. They are parasites upon it. And if allowed to run high carnival with no questioning from the public, they will casually break the country.

I am sure that some woke politicians would like to take a different tack and would like to celebrate how nationalistic, how patriotic, how wonderful they are in their attempt to assert the identity of this place and somehow prove that we are no longer under colonialism because that is absolutely what they need to do in becoming the heroes of the Global South and heroes for their generation.

To that, I say, rather than taking a page from woke people who were unsuccessful in everything they did, it seems more logical to me to take what Lee Hsien Loong had once suggested or hinted at in his 2015 S Rajaratnam lecture, which is well worth a watch.

If your country does not have itself together, if its things are not in order, if it is not doing well, it can say a million different things but nobody will ever listen. It is nice to preach justice and talk about how beautiful, wonderful, and amazing you are, but at the end of the day, if you cannot even handle simple and basic things, then there is no point in your talking because people will not listen to you.

It is natural and understandable that that is so.

After all, you cannot give what you do not have, and if what you do not have is the basic common sense to be able to realise that you should not be dealing with this kind of woke policy, it beggars belief as to how it is that you could ever proclaim that you are a hero for justice, or anything worthy of emulation for anything other than a coincidence of geography and the good fortune of natural resources.

How lucky Malaysia is to have these. With these kinds of leaders, if they had inherited Singapore instead, it is incomprehensible how they could have ever survived.

I will be writing a series of IB Diploma sample IA commentaries soon, and this will be one of the many case studies. Please look forward to it and make sure to bookmark this page, RSS feed it, or track it by signing up for our newsletter to make sure that you don’t miss out on everything that’s going on. Of course, signing up for a premium membership if you don’t have one already is a great idea.

Thank you for reading, and I look forward to seeing you in the next one!

Sepupu.