The Economics of Flip-Flopping: Malaysia, Singapore, and the Price of U-Turns

I wanted to write a little bit more about this because I think it’s a very important topic – it is a problem that affects Malaysia and will continue to affect it for the foreseeable future, and it is something that I deeply disdain. Still, here we are, facing it head-on. This is the economics of flip-flopping on this strange pathway of flip-flops that make up the Malaysian world.

Introduction

Chaos and scrambling defined Malaysia’s brief experiment with a Bahasa Malaysia-only e-commerce rule. In June 2025, the government announced that all product titles and descriptions on major online marketplaces must be in the national Malay language. Overnight, thousands of online sellers rushed to comply – frantically feeding their listings into Google Translate and pleading for help in seller forums(malaymail.com).

Yet barely three days later, amid an outcry from businesses and consumers alike, enforcement of the language mandate was abruptly “paused” and shelved(malaymail.com).

Yet another policy U-turn had been born.

This dizzying episode – from hasty decree to humiliating climb-down – is a textbook case of policy flip-flopping in action.

It highlights how decision-making driven by knee-jerk populism or nationalist sentiment, without thorough economic sense, can yield nothing but disruption and wasted effort. But just how bad is flip-flopping, really? What are the economics underlying these sudden reversals, and what lessons do history and our neighbors teach about the true cost of policy U-turns?

What Is Policy Flip-Flopping?

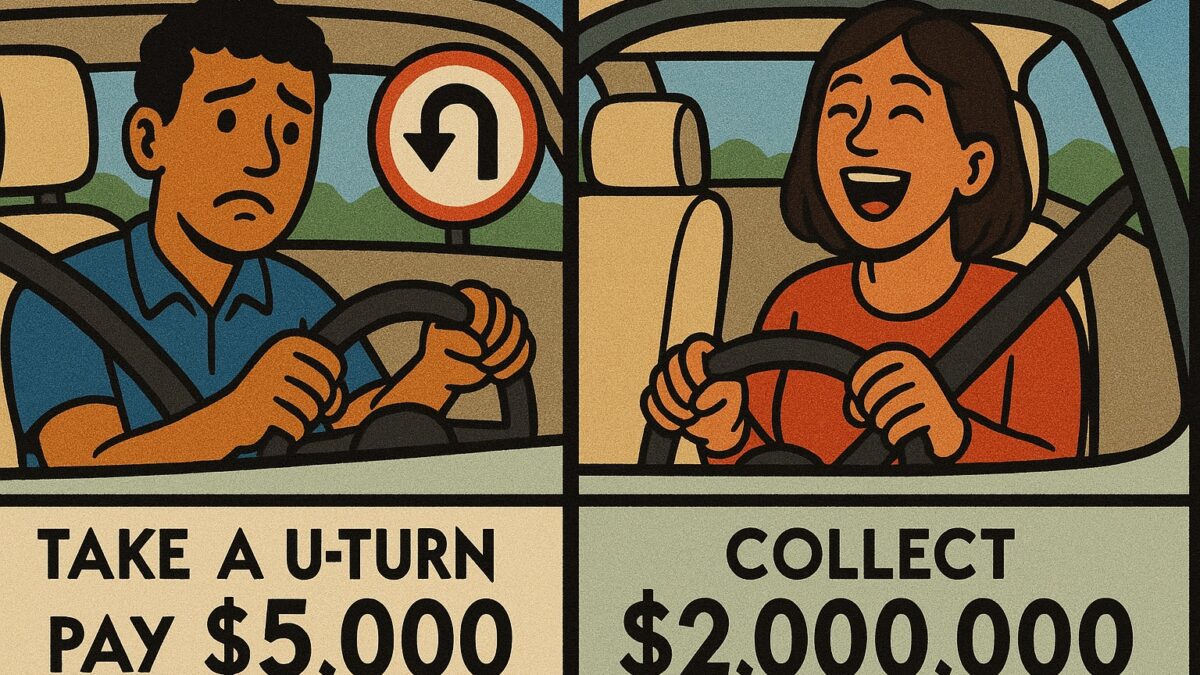

In public policy, flip-flopping refers to the habit of frequently reversing or vacillating on decisions – especially major policies – soon after they are adopted. It is essentially an about-face or U-turn by policymakers, often in response to backlash or second thoughts.

Flip-flopping can occur in regulatory matters (like the online language rule above) or in fiscal decisions (such as tax or budget policies that are enacted and then quickly repealed). Operationally, a flip-flop means that businesses, investors, and citizens face a whiplash of changing rules. One week a new regulation or tax might be imposed; the next week it is watered down or withdrawn.

On a regulatory level, this could mean sudden compliance burdens that are then rendered moot. For example, a ministry might ban a certain product or mandate a new standard, only to undo it days later – leaving firms that scrambled to obey feeling frustrated and burned. On a fiscal level, flip-flops could mean abrupt shifts in government spending or taxation. A classic case would be a government introducing a tax hike or a subsidy cut in a budget, then reversing it after public protest. The result is confusion: households and companies cannot plan if the tax rate today might be gone tomorrow.

Flip-flopping often goes hand in hand with policy uncertainty. Economists define this as the lack of confidence economic actors have in the stability of rules. High uncertainty translates into real costs: research shows that when policy is unpredictable, firms delay investment and hiring. In fact, one influential study found that elevated policy uncertainty “raises stock price volatility and reduces investment and employment” in sensitive sectors(policyuncertainty.com). The logic is simple: if you fear the “rules of the game” may change arbitrarily, you wait rather than spend. Thus, beyond the immediate chaos of each reversal, a culture of policy flip-flops can inflict lasting economic damage by eroding the credibility of the government’s commitments.

The Immediate Costs of a U-Turn

When a policy is announced and then quickly reversed, there are immediate transaction costs and opportunity costs inflicted on the economy. Transaction costs include all the resources expended to adapt to the new policy – money spent, time invested, contracts changed – which become wasted once the policy U-turns. In the Malaysian e-commerce saga, the transaction costs were evident: countless sellers spent hours translating product descriptions into Malay (or hiring others to do so), and marketplaces likely had to deploy technical fixes for bilingual listings. These efforts, undertaken in haste, became sunk costs when authorities suspended the rule. As one report noted, online sellers had “scrambled overnight to translate listings, flooding online communities with concerns and complaints”(malaymail.com) during the brief window when the rule appeared imminent. All that scrambling was for naught.

The opportunity cost is the value of what could have been done with those resources if they hadn’t been diverted by the flip-flop. Every ringgit and hour thrown at complying with a soon-to-be-reversed policy is a ringgit or hour not spent on productive activity – developing new products, improving services, or training employees. Flip-flops act like a tax on productive behavior, except the tax doesn’t even yield revenue or any lasting public benefit. Instead, it yields policy “corpses,” as Malaysia’s flip-flop graveyard of shelved initiatives attests.

Then there is the reputational cost. Each reversal chips away at the government’s credibility. If policies appear driven by “pandering to nationalist sentiment and decision-making without common sense,” as the frustrated observers often put it, stakeholders – from local entrepreneurs to foreign investors – lose faith in the wisdom and consistency of governance. This credibility deficit can show up as a risk premium: investors may demand a higher return to compensate for policy risk, or they may simply take their capital elsewhere to more predictable environments.

Case Study: Malaysia’s Language Policy U-Turn

Malaysian sellers grappled with new language requirements on e-commerce platforms in mid-2025. The government’s sudden mandate that all online product listings be provided in Malay triggered a frantic rush to translate thousands of descriptions, only for the policy to be suspended days later amid backlash(malaymail.com).

Consider in depth the example that opened our discussion: Malaysia’s short-lived attempt to impose Malay-language labels on the online marketplace. Announced as part of new consumer protection regulations, the rule required all product titles and descriptions to be in Bahasa Malaysia (with allowances for brand names and optional translations)(malaymail.com). Officials no doubt saw it as a move to elevate the national language and perhaps please certain nationalist constituencies. But it appears little thought was given to practical economics: Malaysia’s online sellers list millions of products, many catering to multilingual or international audiences, and translating everything to Malay overnight was an enormous ask. Moreover, enforcement was set to begin almost immediately (June 24, 2025, according to the regulation)(malaymail.com), giving businesses virtually no grace period.

The result was, predictably, chaos. Within hours of the news, sellers large and small were trying to comply – a vivid illustration of transaction costs being incurred in real time. E-commerce forums lit up with panicked posts; some vendors shut down their listings temporarily rather than risk non-compliance. Malay translation plugins and services saw a spike in demand as rapid-fire visits to Google Translate became the norm. One can only imagine the scramble in companies that rely on thousands of product listings: the task was herculean and the deadline only days away.

What unfolded next is telling. Just as the seller community braced for the new rule’s enforcement, the government blinked. Facing a wave of public backlash, the Ministry announced a temporary suspension of the Malay-only mandate on June 23, 2025 – effectively a repeal before the policy even truly began(malaymail.com). High-level meetings with major platform operators were hastily arranged to “gather feedback,” and officials conceded that the implementation would be reviewed and delayed indefinitely. In short, the policy was dead on arrival, a casualty of its own poorly considered design.

This flip-flop had all the hallmarks of the pattern we described. A sudden rule, justified more by nationalist rhetoric than by economic logic, led to immediate costs for businesses. Those costs yielded no benefit, as the policy was abandoned. And the incident almost certainly dented the government’s credibility. Next time regulators announce a major rule, stakeholders might be forgiven for asking: “Are they going to stick with this? Or is it another stunt that will quietly be reversed?” Over time, that skepticism can harden into a general wariness about Malaysia’s policy environment.

Notably, the language-listing saga is not an isolated case in Malaysia. There’s also the whole beautiful saga of the PPSMI whereby the country vouched to teach science and mathematics in English, wrote that back, brought in the DLP, decided to roll that back, decided to continually raise hell about signboards and the English language and the Malay language while a hundred thousand different people declared that we are no longer being colonized and therefore should not be speaking English for reasons that up until now I still cannot fathom or comprehend beyond recognizing that there are some people who are just very bad at the English language, cannot perform when they are expected to speak it and want to reduce everybody down to their level.

In any case, policy reversals are not new to Malaysia. The country has seen numerous policy reversals beyond language policy over the years, especially when measures provoke public discontent or threaten entrenched interests.

For example, a few years prior, the Malaysian government introduced a broad-based Goods and Services Tax (GST) in 2015 to shore up revenues – only to abolish it in 2018 after it became politically unpopular, reverting to the old sales tax system(channelnewsasia.com).

Malaysia is, in fact, the only country in the world to implement a full GST and then roll it back entirely in such short order. The GST flip-flop left businesses perplexed (after investing in new accounting systems for GST) and signaled that even cornerstone fiscal policies could be upended by election-cycle pandering. “We need to send out a consistent long-term message and have the required commitment if we want FDI to create employment and improve quality of life for Malaysians. Haven’t we learnt anything from Singapore?” one Malaysian commentator pleaded in 2018, in the wake of that tax reversal(malaysiakini.com).

Flip-Flops Around the World: History and Examples

Malaysia is far from the only country with policy U-turns; the annals of economic history are littered with abrupt reversals, often born of political expediency. A classic example is the United States’ experiment with Prohibition in the early 20th century. In 1920, bowing to moral reform movements, the U.S. outlawed the manufacture and sale of alcohol – an economic and social policy upheaval. The policy proved not only unpopular but counterproductive (fueling organized crime and speakeasies), and by 1933 the government performed a U-turn, repealing Prohibition. That flip-flop at least corrected a mistake, but it came after years of economic distortion and lost tax revenue. It underscored a lesson: policies enacted to appease fervent but temporary public sentiments can impose costs with little lasting benefit.

In more recent times, India provided a dramatic case. In 2020, Prime Minister Narendra Modi’s government passed three sweeping farm laws aimed at liberalizing agriculture markets. The reforms might have made economic sense on paper to some analysts, but they were rolled out without adequately consulting farmer stakeholders. Massive protests erupted across India; farmers feared the changes would devastate their livelihoods. For a year, demonstrations paralyzed highways and garnered global attention. Eventually, the political pressure grew too great – and in November 2021, Modi’s government capitulated and repealed the farm laws in their entirety. A Reuters report noted that growers had effectively forced the government’s hand to repeal laws that the administration initially insisted were vital(reuters.com). The flip-flop was celebrated by protesting farmers but also raised questions about India’s reform credibility. Future attempts at economic reform in India may meet greater skepticism, as interest groups calculate that even passed laws can be rolled back if enough noise is made.

Even wealthy, developed nations fall into flip-flop traps, especially when populist politics collide with economic reality.

The United Kingdom, for instance, suffered a notorious policy U-turn in 2022 during the short-lived tenure of Prime Minister Liz Truss. Truss’s government, eager to stake out a bold agenda, unveiled a surprise “mini-budget” that included sweeping tax cuts for the wealthy funded by heavy borrowing.

This ideological gambit, aimed at pleasing a segment of her party and creating a Thatcher-esque legacy, immediately spooked financial markets. Investors, long accustomed to Britain being a pillar of prudence, were aghast at the unfunded tax breaks(reuters.com). The pound’s value plummeted and UK bond yields soared; within days the Bank of England had to intervene to stabilize pension funds.

Facing a full-blown crisis of confidence, the government executed a humiliating reversal: the tax cut for top earners was abandoned just over a week after being announced. As one Conservative MP lamented, “The damage has already been done. We just look incompetent now”. Indeed, the flip-flop cost Truss her credibility and, ultimately, her job – she resigned after only 45 days in office, making her the shortest-serving PM in British history. The British case revealed how investor confidence can be rapidly destroyed by a policy swerve, and how difficult it is to regain once lost. What was meant to be a legacy-making stroke (an economic reset toward low taxes) ended up dramatically backfiring because it was ill-timed and quickly withdrawn under duress.

Other examples abound. The “poll tax” in the UK (a flat per-head local tax) in 1990 was introduced by Margaret Thatcher only to be hastily scrapped in 1991 after it sparked riots and contributed to Thatcher’s fall from power. In France, the government in 2018 imposed a new fuel tax as part of environmental policy, but nationwide “gilets jaunes” (yellow vest) protests against high fuel prices forced Paris to suspend the tax increase. In each scenario, a policy implemented without sufficient buy-in or sensible pacing was met with fierce public resistance, culminating in a reversal. Such episodes illustrate the universal challenge policymakers face: if reforms are too disruptive or perceived as too unfair, a flip-flop – however embarrassing – may become politically unavoidable.

What drives these flips? Often, it is politics and personality over sound economics. Leaders sometimes enact drastic measures to pander to a base or to craft a personal legacy, without building a broad consensus or considering long-term costs. When the expected backlash comes, the same leaders (or their successors) then retreat to stem the political bleeding. In some cases, the initial policy might have been economically harmful; in others, it might have been beneficial had it survived, but the lack of steady leadership doomed it. Either way, oscillating between policy extremes tends to leave a nation worse off than if no change had been attempted at all.

The Theory: Why Flip-Flopping Hurts Economies

At the theoretical level, frequent policy reversals impose a form of uncertainty tax on the economy. From a macroeconomic perspective, policy flip-flops contribute to what economists call regime uncertainty – a situation where people are unsure about the rules that will prevail in the future. In the 1930s, during the Great Depression, some historians argue that the erratic shifts in U.S. government policy (wage controls, gold standard changes, fiscal stimulus and retrenchment) created an atmosphere of uncertainty that hampered recovery. More formally, modern economic research has quantified how uncertainty about policy correlates with reduced economic activity. When firms are unsure if a new regulation or tax regime will last, they behave as if they have an option to wait – deferring capital investments, hiring, or expansion until the uncertainty is resolved. The result can be a measurable drag on growth and productivity.

Frequent flip-flops also undermine the time consistency of policy. In economic theory, a policy is time-consistent if policymakers have an incentive to stick with it in the future. When governments develop a reputation for inconsistency – saying one thing and later doing another – they lose the ability to shape expectations. For instance, a central bank that flip-flops on its inflation target will find that people stop believing its pronouncements, making it harder to anchor inflation expectations. Similarly, a government that flip-flops on business regulations will struggle to convince entrepreneurs to take its future promises seriously. This credibility problem can lead to a vicious cycle: because policymakers know their credibility is low, they might overreact with even more short-term maneuvers (to appease various groups), which only further erodes long-term credibility.

From a microeconomic standpoint, each flip-flop introduces direct costs as discussed: compliance costs, legal fees, administrative overhead to reverse course, and so on. We can analogize a policy change to a company repricing its products – in economics, changing prices incurs “menu costs” (like printing new menus). Likewise, changing policies has administrative “menu costs” for government and businesses alike. When a policy is flipped back and forth, those costs multiply. Imagine a factory that retools its assembly line to meet a new regulation, only to have the regulation repealed – the factory may then need to retool again or scrap the investment. Such whipsaw effects waste capital. In Malaysia’s case of the GST, companies had to overhaul their billing and reporting systems to charge GST in 2015, then overhaul them again to revert to SST in 2018. It’s been estimated that this back-and-forth cost Malaysian businesses significant sums, not to mention the government’s loss of a stable revenue source. The benefit of stable policy is that it allows long-term planning and amortization of compliance costs. Flip-flopping forfeits those benefits.

Another theoretical lens is opportunity cost: the unseen losses from paths not taken. When policymakers spend time on symbolic gestures that are then reversed, they divert political capital and administrative resources away from potentially productive reforms. Every ministry meeting devoted to instituting (and then repealing) a flawed policy is a meeting not spent solving other problems. For countries with limited bureaucratic bandwidth, flip-flops are particularly harmful because they squander government capacity. One could argue that Malaysia’s focus on things like enforcing Malay on e-commerce, or sudden quota changes in various sectors, takes attention away from deeper structural issues (education, innovation policy, etc.). The opportunity cost of flip-flops is thus reform stagnation in areas that truly matter for long-run prosperity.

Confidence: The Singapore Comparison

If flip-flopping erodes confidence, then consistency should build it. Nowhere is this contrast clearer than in the divergent trajectories of Malaysia and its neighbor Singapore. The two countries started from roughly similar per capita income levels at the time of their separation in 1965 – Singapore’s GDP per person was about US$511, Malaysia’s was around $335 that year(lup.lub.lu.se). But in the decades since, Singapore’s economy has leapfrogged, with income per capita now five to six times higher than Malaysia’s. Former Singaporean Prime Minister Lee Kuan Yew (LKY) often attributed his country’s success to one key intangible: confidence. “If I have to choose one word to explain why Singapore succeeded, it is ‘confidence’,” LKY said(todayonline.com). By this, he meant the confidence that investors, both foreign and local, have in Singapore’s governance – the trust that policies are stable, rational, and oriented to the long term.

Singapore painstakingly cultivated an image (and reality) of policy consistency and rule of law. The government there is known for careful, technocratic planning and generally avoiding knee-jerk reversals. Policies are debated thoroughly, implemented gradually, and typically kept in place with minor adjustments rather than scrapped wholesale. This doesn’t mean Singapore never changes course – it does, when evidence dictates – but it rarely does so in a panicked or politically capricious manner. The value of that steadiness has been incalculable. Investors built factories and refineries in Singapore in the 1960s and 70s despite the city-state’s lack of natural resources, partly because they trusted the government not to pull the rug out from under them. As one account recalls, during the 1973 oil crisis LKY personally assured multinational oil companies that Singapore would not nationalize or expropriate their stock of oil (even though keeping the oil might have buffered Singapore’s domestic supply)(todayonline.com). By sharing in the pain of global shortages rather than seizing a short-term advantage, Singapore signaled that it would honor commitments and not change rules arbitrarily. That move reinforced Singapore’s reputation for reliability – a stark contrast to the fear in some other countries that “at the stroke of a pen, they can take it over,” as LKY once warned about Malaysia’s unpredictability(malaysiakini.com).

The payoff was real: international confidence in Singapore grew, and companies poured in investment. Singapore today hosts regional headquarters of countless global firms and enjoys one of the highest rates of foreign direct investment (FDI) per capita in the world. Meanwhile, Malaysia, with its more erratic policy path, has often struggled to attract the same level of investment relative to its size. Malaysian commentators have long noted that the country’s habit of flip-flopping has undermined its FDI appeal. “The lack of a consistent long-term policy is not helping Malaysia in bringing in FDI,” wrote one observer, urging the country to learn from Singapore’s example of policy clarity(malaysiakini.com).

The numbers bear this out. In recent years, Singapore has routinely pulled in FDI inflows that vastly exceed Malaysia’s. For instance, in 2022 Singapore attracted around US$149 billion in net FDI inflows, compared to about $15 billion for Malaysia(macrotrends.net). Even accounting for Singapore’s role as a financial hub, the gap is striking. Singapore – a tiny nation of 5.7 million – often rivals or exceeds Malaysia (population ~32 million) in total investment received. In per capita terms, the difference is enormous. By 2018, Singapore’s GDP per capita was around $61,000, whereas Malaysia’s was about $10,700 (mgmresearch.com). As of 2024, Singapore’s per capita income has topped $90,000, roughly 7 times Malaysia’s level(countryeconomy.com). While many factors explain this divergence, investor confidence is undoubtedly a major one. Lee Kuan Yew explicitly noted that foreign investors were willing to “bet their future” on Singapore because of the confidence its governance inspired(fifthperson.com).

Confidence, once lost, is hard to rebuild. Malaysia in the 1990s was seen by some as an attractive “Asian Tiger” economy, but episodes like the 1997–98 capital control measures (when Malaysia fixed its currency and broke from prevailing IMF advice, a bold move that itself remains debated) and later flip-flops have given investors pause. Even domestic business people sometimes complain about the unstable policy landscape – from unpredictable approvals to sudden regulatory shifts – which adds a layer of risk to any long-term project. In contrast, Singapore’s consistent approach created a virtuous cycle: confidence bred investment, which bred growth, which further enhanced confidence in a self-reinforcing loop.

It’s worth mentioning that confidence is not just about pleasing foreign investors; it also means confidence among a country’s own citizens and entrepreneurs. Singapore’s people developed trust that their government’s policies, even if strict at times, would be maintained and would ultimately aim for the nation’s prosperity. This enabled tough policies (like a mandatory savings scheme or industrial restructuring plans) to succeed without public revolt. Malaysia’s public, by comparison, has at times grown cynical from seeing policies come and go. If people suspect a new plan is just a political gimmick, they are less likely to support or comply with it wholeheartedly, potentially creating a self-fulfilling failure.

The Hidden Dangers of Flip-Flopping

Beyond the immediate economic costs, flip-flopping in policy carries deeper political and structural dangers. Frequent U-turns can be both a symptom and a cause of political instability. In Malaysia’s case, some of the flip-flops of recent years have coincided with a rapidly changing political landscape – the country saw three prime ministers between 2018 and 2021, each with different priorities. A fragile ruling coalition might announce one policy to satisfy one faction, only to reverse it under pressure from another faction or public opinion. This gives the impression of a government constantly in reactive mode, rather than following a steady strategic vision.

Such an environment can erode respect for the rule of law and institutions. If regulations are seen as temporary whims, people may become less inclined to follow them or to take government directives seriously. In the worst case, it can encourage a kind of policy cynicism or even administrative paralysis: civil servants might delay enforcement of new rules on the assumption they’ll be reversed, and businesses might engage in more lobbying and rent-seeking, figuring that enough noise can get an unwanted policy canceled. Indeed, if flip-flopping becomes routine, it incentivizes interest groups to mobilize and exert maximal pressure at the hint of any policy they dislike – after all, they’ve seen that loud protests or social media campaigns can yield an immediate U-turn.

There is also a connection between flip-flopping and the quality of governance. Durable, sound policies typically emerge from careful study, stakeholder engagement, and sometimes the political courage to implement them fully and transparently. Flip-flop policies, by contrast, often come from top-down impulses or spur-of-the-moment political calculations. They may bypass rigorous analysis or consultation. The Malay-only e-commerce rule, for example, had it gone through extensive dialogue with industry, might have been adjusted or delayed rather than sprung as a surprise. The fact that it wasn’t suggests a governance process susceptible to populist pressure or the influence of a few personalities. This hints at deeper issues in how policy is made. When institutions are strong, they act as brakes on whimsical changes – think of an independent central bank or a professional civil service that can caution against folly. When institutions are weaker, leaders can impose policies on a whim, but they are just as quick to rescind them when the political winds shift.

For economies, such weaknesses are red flags. Multinational firms often perform a “political risk” assessment before investing in a country: they look at not just the laws on the books, but how likely those laws are to change, and how well-governed the nation is. Policy flip-flops signal higher political risk. Investors may worry, for instance, that a lucrative concession or tax incentive granted today could be revoked tomorrow if the government changes its mind. Or conversely, that new burdens could be suddenly imposed. As a result, they might either invest less or demand a higher return (to compensate for risk), raising the cost of capital for that country.

For the broader society, flip-flopping can also fray the social contract. Citizens expect a certain degree of consistency and fairness from their government. When policies zigzag, it often means some group gets hurt in the zig and another in the zag. Trust in public leadership can diminish, leading to apathy or resentment among the populace. In democratic contexts, this might manifest as voter swings and unstable electoral outcomes, further incentivizing short-termist policy thinking – a negative feedback loop.

Finally, consider the resource allocation implications. Economic development is essentially about allocating resources – labor, capital, talent – to their most productive uses. A stable policy environment is like a steady compass for that allocation: entrepreneurs can commit to long-term projects, workers can invest in training for industries that policymakers consistently support, and capital can be sunk into infrastructure that will be useful under enduring regulations. But in a flip-flop environment, resources often end up allocated based on transient policies. For example, if a government heavily incentivizes a sector (say, green technology) one year and then abruptly withdraws those incentives the next, you may get half-built solar farms or bankrupt startups as a result. The economy might have been better off allocating those resources elsewhere from the start, rather than riding a policy rollercoaster. In short, flip-flopping can lead to misallocation, where resources chase the flavor-of-the-month policy and then are left stranded when the flavor changes.

Principles Over Pandering: The Perils of Half-Hearted Nationalism

An underlying theme in some flip-flops is the tension between economic pragmatism and ethno-nationalist or populist politics. Many countries, Malaysia included, grapple with identity-based economic policies – whether favoring certain ethnic groups in business, mandating local language use, or protecting “national champions” enterprises.

These policies are often controversial: proponents argue they uphold national interests or social justice; critics say they hinder efficiency and competitiveness. The worst outcomes, however, seem to arise when leaders oscillate between pushing a nationalist agenda and retreating from it when it’s inconvenient.

If a government is determined to pursue an ethno-nationalist economic strategy (however costly that might be), one could argue it should do so consistently so that at least businesses know what to expect.

For example, if Malaysia truly believes that all commerce should be conducted in Malay for cultural reasons, then it would need to commit to that principle staunchly and implement it gradually but firmly (with due support to those affected) – and crucially, be willing to bear the economic costs (like possibly reduced international participation in its markets) in exchange for the cultural goal.

What we see instead in the flip-flop cases is posturing without perseverance. A nationalist-tinged policy is announced with great fanfare to appease certain groups or signal “patriotism,” but when negative consequences loom, the government balks and abandons the policy. This neither achieves the nationalist goal nor avoids the economic costs – it combines the worst of both worlds.

Pandering to nationalist sentiment in bursts is unlikely to produce meaningful benefits. For instance, requiring Malay on e-commerce platforms, even if fully implemented, was doubtful to significantly bolster Malay language usage or improve national unity (consumers who prefer English or Chinese in some contexts would still find workarounds, and foreign sellers might just exit the platform). Meanwhile, the policy risked reducing consumer choice and Malaysia’s attractiveness as an e-commerce hub. National pride cannot be successfully instilled via half-baked mandates that are not seen through. In fact, repeated flip-flops on such issues might even breed cynicism among the very nationalists the policy was meant to impress, as they see their leaders talk a big game but back down at the first sign of trouble.

Thus, one lesson is that economic policy should not be treated as a short-term popularity lever – at least not without expecting a loss of credibility. If a government truly prioritizes a noneconomic objective (like cultural preservation), it should be transparent about the trade-offs and consistent in its application, so that society can adjust and perhaps even rally behind it. But using these sensitive issues as political yo-yos – tightening when convenient and loosening when it hurts – simply convinces everyone that the leadership lacks both conviction and competence.

History suggests that pragmatism tends to win out eventually in economics. Countries that single-mindedly pursued autarky or rigid nationalist economics often had to liberalize later on out of necessity (consider how post-Mao China reversed course on self-reliance and opened up, or how India moved away from its “License Raj” in 1991). However, those reversals, if done decisively and with a plan, can be beneficial corrections. The problematic flip-flops are those done in bad faith or without clear strategy. They reveal a kind of identity crisis in policymaking: a country’s leadership that cannot decide whether to embrace global best practices or inward-looking populism, and ends up zigzagging between the two, satisfying no one.

For Malaysia, the contrast with Singapore is again illuminating. Singapore under LKY was unabashedly pragmatic – it prioritized economic growth and competency over ideology, even if that meant abandoning certain socialist instincts or, conversely, embracing state intervention when it suited development. Malaysia’s leadership, in various eras, has been more torn: championing free markets and foreign investment at times, while at other times leaning into race-based quotas or protectionism for political gain. It’s tried to have it both ways, but the inconsistent signals have arguably held it back. As Lee Kuan Yew once dryly observed regarding investing in Malaysia: you must remember that investments on Malaysian soil can be undone “at the stroke of a pen”malaysiakini.com. His advice to would-be investors carried the implied warning: Malaysia’s changing rules reflect an unpredictable governance, which is risky. Singapore, by contrast, strove to make sure no investor would feel that way about their jurisdiction.

Conclusion: Flip-Flopping Forward – What the Future Holds

What does history teach us about the economics of flip-flopping? First, that stability and credibility are precious assets in economic management. Countries that have upheld them have generally thrived, while those that squander them pay a price. Flip-flopping, by undermining stability, chips away at the foundation of sustained growth. While any single U-turn might seem minor, the cumulative effect of many U-turns is to paint a picture of an unpredictable business climate. Capital and talent can be skittish; they flow to places where the rules of the game are clearer. The enduring success of Singapore – encapsulated by that one word “confidence” – stands as evidence of how far a reputation for steadiness can take a nation. Conversely, Malaysia’s relative underperformance despite abundant resources and a strategic location suggests that policy missteps and flip-flops have tangible opportunity costs in terms of missed investments and slower growth.

Second, history shows that policy discipline is as important as policy choice. A decent policy sustained is often better than an excellent policy that is reversed next year. Consistency allows positive effects to compound. Frequent reversals prevent any policy (good or bad) from having time to work, leaving behind only the costs of transition. Of course, governments should correct truly harmful policies, but the bar for reversal should be high – ideally only after careful evaluation and consideration of alternatives. Knee-jerk flip-flops to chase public opinion erode the long-term quality of governance.

Third, political will and communication matter. If reform is needed, leaders must be willing to invest political capital in explaining and standing by it (at least long enough to fairly judge its outcomes). If a policy is not truly believed in – if it’s enacted just for show – then it likely shouldn’t be enacted at all. The courage to either commit or not commit, rather than to constantly zigzag, is a mark of mature leadership. Many successful reforms in various countries were initially unpopular, but consistency and good results eventually won skeptics over. If Thatcher’s government in the UK had immediately flip-flopped on economic liberalization in the 1980s, Britain might not have broken out of its 1970s stagnation (though in her case, she infamously refused to U-turn on most things – “the lady’s not for turning,” she declared, until political reality finally forced her out on the poll tax issue). The point is not that all steadfast policies are right, but that without steadfastness, even the right policies can fail.

For Malaysia, avoiding the flip-flop trap will likely require strengthening institutional processes. This might include more rigorous policy analysis units, stakeholder consultations to iron out issues before implementation, and perhaps mechanisms to bind the government to medium-term plans so that it cannot so easily flip with the political winds. It might also require a cultural shift in politics – away from the quick win of pandering and towards rebuilding public trust through consistency and results. There are signs of awareness: Malaysian economists and business groups frequently call for more predictable policies, and recent governments have at least voiced commitment to policy stability (for instance, by signing investment treaties or fiscal responsibility legislation that make reversals harder). But actions will speak louder than words.

If flip-flopping continues unabated, the danger is a kind of equilibrium of mediocrity. In such a scenario, Malaysia (or any country stuck in this pattern) could see investors increasingly favor more stable neighbors, its own innovators possibly moving abroad, and its growth prospects dimming as each policy false-start saps momentum. Already, one can observe that some multinational businesses choose Singapore or even Vietnam over Malaysia for regional headquarters or new factories, citing more predictable operating environments. Over time, this could widen the very gaps Malaysia seeks to close as a developing economy.

On the other hand, a steadfast commitment to sensible, well-considered policies could yield a turnaround in perceptions. Malaysia has many strengths – a young workforce, rich resources, strategic geography – and if it can couple those with a renewed focus on consistent policy execution, it could unlock a higher growth path. Consistency would breed the confidence that Lee Kuan Yew emphasized, which in turn could spur greater investment and innovation domestically.

In conclusion, the economics of flip-flopping teaches a simple but profound lesson: stability has immense value. The price of U-turns is paid not just in immediate disruption but in lost trust and lost opportunity. Policymakers should remember that while changing one’s mind in light of new evidence is wise, changing it capriciously or under transient pressures is costly. Flip-flops may sometimes be politically expedient in the short run, but they carry long-run economic penalties. Nations that master the art of consistent, principle-based governance tend to flourish, while those stuck in flip-flop cycles risk being left behind. As Malaysia reflects on episodes like the Malay language fiasco, the hope is that it heeds the warnings of history. A future where policy is driven by clear-eyed strategy rather than spur-of-the-moment impulses will not only prevent the chaos of scrambling Google Translate nights – it will also set the stage for more durable prosperity and public confidence in the years ahead.

Bibliography

Patrick, Ian Jeremiah. “E‑commerce Malay Language Rule Paused, Ministry to Gather Feedback from Sellers.” Malay Mail, June 23, 2025.

Khan, Mohamed Rafick. “Flip‑Flops Decisions Will Not Help Our FDI.” Malaysiakini (Letters), August 29, 2018.

Teo, Xuanwei. “Winning Investor Confidence.” Today (Singapore), March 23, 2015.

Baker, Scott R., Nicholas Bloom, and Steven J. Davis. “Measuring Economic Policy Uncertainty.” NBER Working Paper No. 21633, October 2015.

Piper, Elizabeth, Andrew Macaskill, and Alistair Smout. “Truss Forced into U‑Turn on Tax After Week of Market Turmoil.” Reuters, October 3, 2022.

Bhardwaj, Mayank, and Rajendra Jadhav. “Why Are Indian Farmers Protesting Again? Demands for Government Explained.” Reuters, February 14, 2024.

Han, Xuehui. A Comparative Analysis of Singapore and Malaysia. Master’s thesis, Lund University, 2010.

Tan, Vincent. “CNA Explains: Why Is Malaysia Considering the Reintroduction of GST and How Receptive Are Businesses?” Channel NewsAsia, June 9, 2022.

Macrotrends. “Foreign Direct Investment by Country.” MacroTrends.net. Accessed June 2025.

MGM Research. “Singapore vs Malaysia – GDP per Capita Comparison 1980–2023.” mgmresearch.com. Accessed 2025.